Last year the European Union has announced new Strong Customer Authentication (SCA) requirements for online payments above €30 in the European Economic Area. Starting 2021, the legislation comes into force.

Apple will support SCA both for the App Store and Apple Pay

Waiting for more news from Google

Stripe also supports SCA

In this article, we will try to explain what exactly developers should expect.

Qonversion also will support SCA for StoreKit in-app purchases and subscriptions so you can be sure your purchases will be handled correctly.

What is going?

How users will approve purchases

We expect it to be similar to 3D-secure – when purchases happen, you receive an SMS code from your bank or a push notification from your bank’s app.

The main question is how it will affect the conversion from install to trial. The regulation has exemptions, and providers like Apple or Stripe can request them.

Last year the European Union has announced new Strong Customer Authentication (SCA) requirements for online payments above €30 in the European Economic Area. Starting 2021, the legislation comes into force.

Apple will support SCA both for the App Store and Apple Pay

Waiting for more news from Google

Stripe also supports SCA

In this article, we will try to explain what exactly developers should expect.

Qonversion also will support SCA for StoreKit in-app purchases and subscriptions so you can be sure your purchases will be handled correctly.

What is going?

How users will approve purchases

We expect it to be similar to 3D-secure – when purchases happen, you receive an SMS code from your bank or a push notification from your bank’s app.

The main question is how it will affect the conversion from install to trial. The regulation has exemptions, and providers like Apple or Stripe can request them.

Last year the European Union has announced new Strong Customer Authentication (SCA) requirements for online payments above €30 in the European Economic Area. Starting 2021, the legislation comes into force.

Apple will support SCA both for the App Store and Apple Pay

Waiting for more news from Google

Stripe also supports SCA

In this article, we will try to explain what exactly developers should expect.

Qonversion also will support SCA for StoreKit in-app purchases and subscriptions so you can be sure your purchases will be handled correctly.

What is going?

How users will approve purchases

We expect it to be similar to 3D-secure – when purchases happen, you receive an SMS code from your bank or a push notification from your bank’s app.

The main question is how it will affect the conversion from install to trial. The regulation has exemptions, and providers like Apple or Stripe can request them.

Last year the European Union has announced new Strong Customer Authentication (SCA) requirements for online payments above €30 in the European Economic Area. Starting 2021, the legislation comes into force.

Apple will support SCA both for the App Store and Apple Pay

Waiting for more news from Google

Stripe also supports SCA

In this article, we will try to explain what exactly developers should expect.

Qonversion also will support SCA for StoreKit in-app purchases and subscriptions so you can be sure your purchases will be handled correctly.

What is going?

How users will approve purchases

We expect it to be similar to 3D-secure – when purchases happen, you receive an SMS code from your bank or a push notification from your bank’s app.

The main question is how it will affect the conversion from install to trial. The regulation has exemptions, and providers like Apple or Stripe can request them.

Start Now for Free

Or book a demo with our team to learn more about Qonversion

Start Now for Free

Or book a demo with our team to learn more about Qonversion

Start Now for Free

Or book a demo with our team to learn more about Qonversion

Read more

Read more

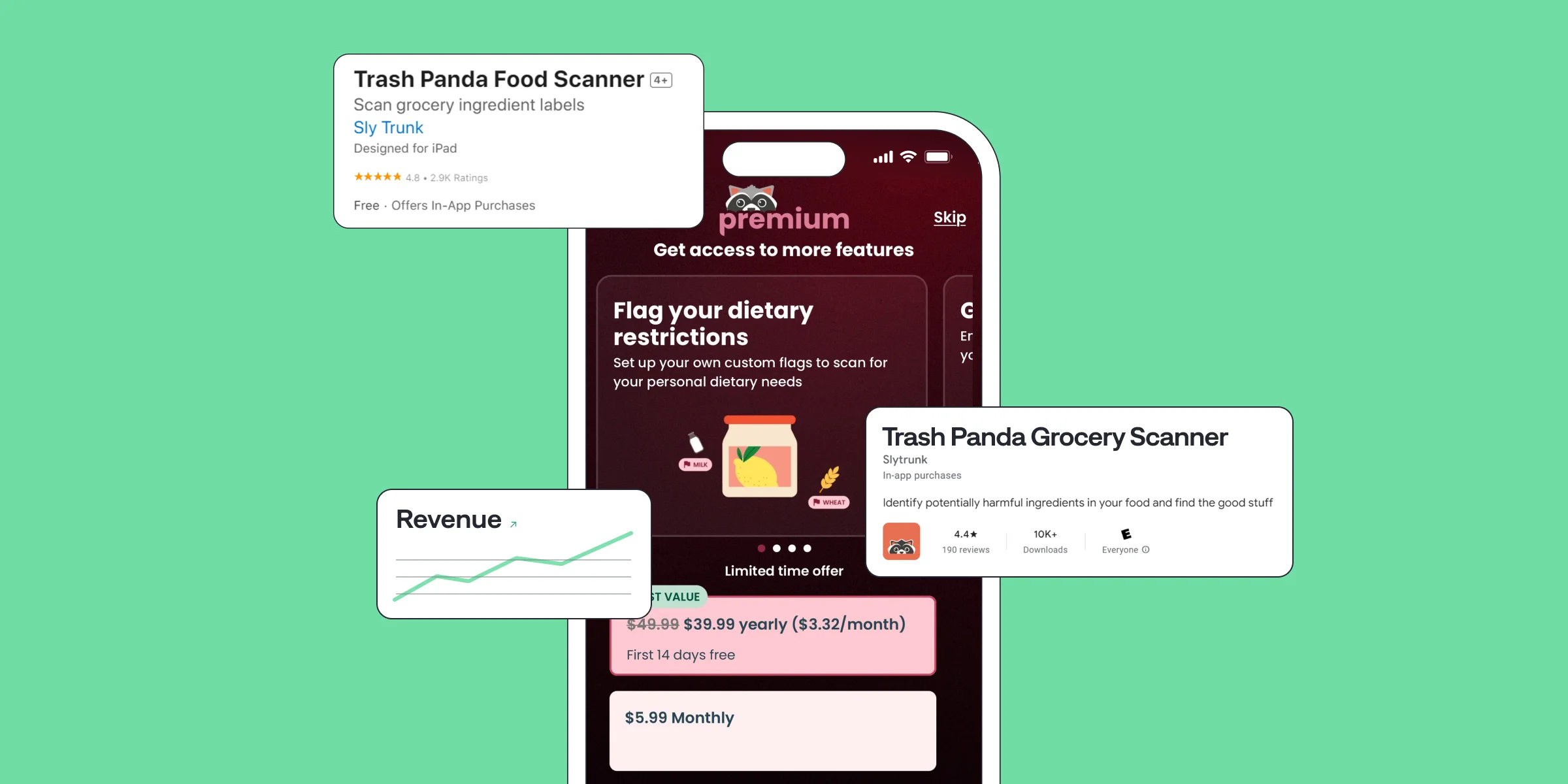

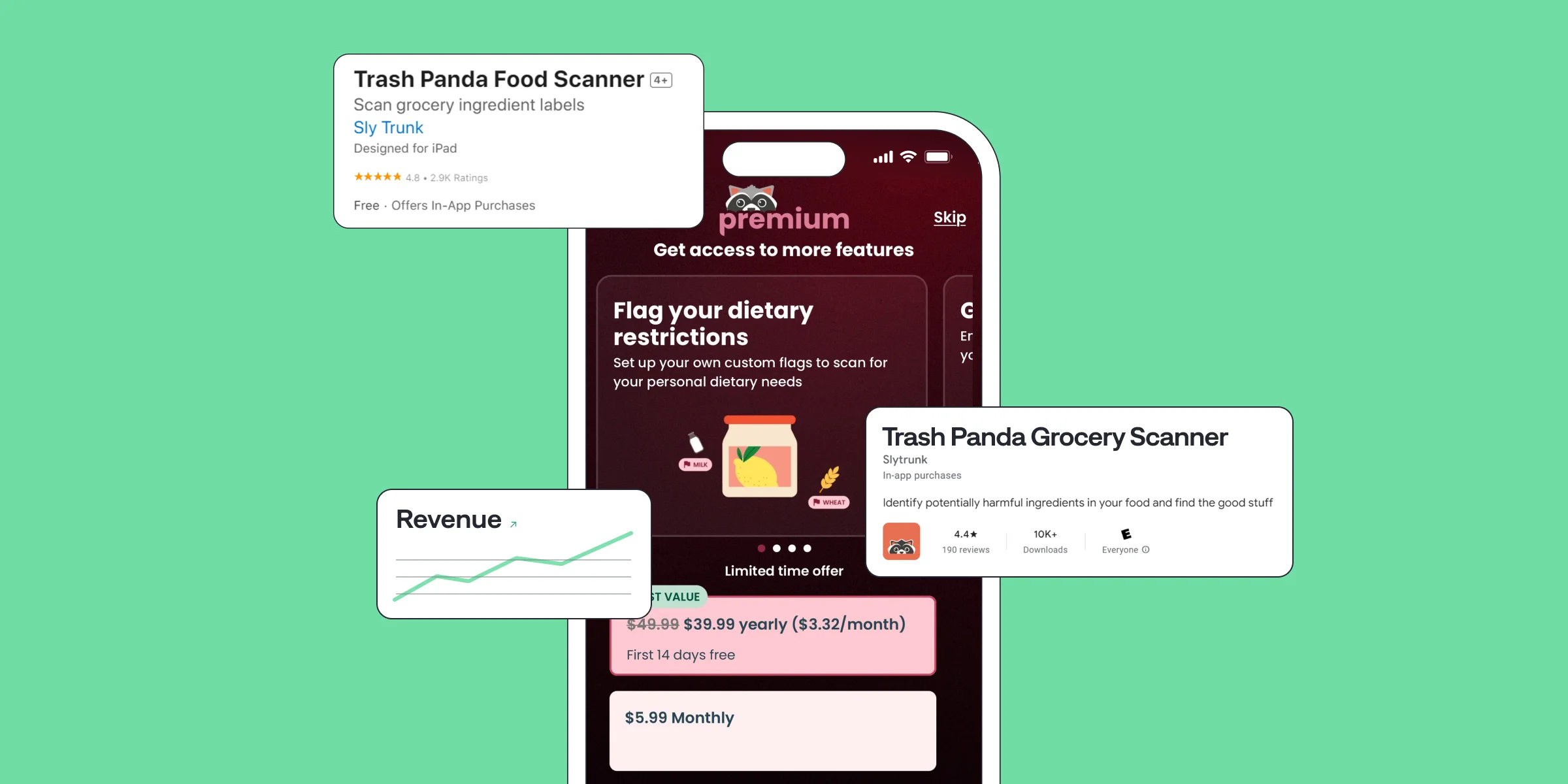

Trash Panda Maximizes App Revenue after Setting the Best Subscription Price with A/B Tests

Jul 8, 2024

Jul 8, 2024

How StyleDNA Saved 20% Development Time and Unlocked New Features

Jun 19, 2024

Jun 19, 2024

WWDC24 Updates for App Developers | What's new in Storekit 2 and App Store Server API?

Jun 17, 2024

Jun 17, 2024

How A/B Testing with Qonversion Helped Iben Sandahl’s Parenting App Double Their Sales

Jun 13, 2024

Jun 13, 2024

Trash Panda Maximizes App Revenue after Setting the Best Subscription Price with A/B Tests

Jul 8, 2024

Jul 8, 2024

How StyleDNA Saved 20% Development Time and Unlocked New Features

Jun 19, 2024

Jun 19, 2024

WWDC24 Updates for App Developers | What's new in Storekit 2 and App Store Server API?

Jun 17, 2024

Jun 17, 2024