Summary

How to Land the Perfect Funding Partner: an App Founder’s Checklist

How to Land the Perfect Funding Partner: an App Founder’s Checklist

Apr 19, 2022

Apr 19, 2022

The highest-performing apps don’t survive by chance — their founders have waded through mountains of data, created the perfect recipe to acquire and retain users, and explored myriad financing options. They build businesses, build products, envision the world differently — and then they raise money to execute this vision. Understanding the funding landscape, the way it relates to your business model, and the interests of investors will help you achieve long-term growth and revenue for your own business.

Choosing the right financing partner requires plenty of preparation and a thorough understanding of your business needs. Mobile apps in particular must consider such essential factors as serving your revenue streams, being conscious of profit models, and finding a financial partner that appreciates the worth of your brand.

When deciding on your next financier, remember to carefully consider each of the following points on this checklist to nail down an effective support system.

The highest-performing apps don’t survive by chance — their founders have waded through mountains of data, created the perfect recipe to acquire and retain users, and explored myriad financing options. They build businesses, build products, envision the world differently — and then they raise money to execute this vision. Understanding the funding landscape, the way it relates to your business model, and the interests of investors will help you achieve long-term growth and revenue for your own business.

Choosing the right financing partner requires plenty of preparation and a thorough understanding of your business needs. Mobile apps in particular must consider such essential factors as serving your revenue streams, being conscious of profit models, and finding a financial partner that appreciates the worth of your brand.

When deciding on your next financier, remember to carefully consider each of the following points on this checklist to nail down an effective support system.

Start Now for Free

Or book a demo with our team to learn more about Qonversion

Start Now for Free

Or book a demo with our team to learn more about Qonversion

Start Now for Free

Or book a demo with our team to learn more about Qonversion

Read more

How will Google Play Store Lawsuit on Monopoly Impact Play Store Commissions and Other Marketplaces?

Oct 10, 2024

Oct 10, 2024

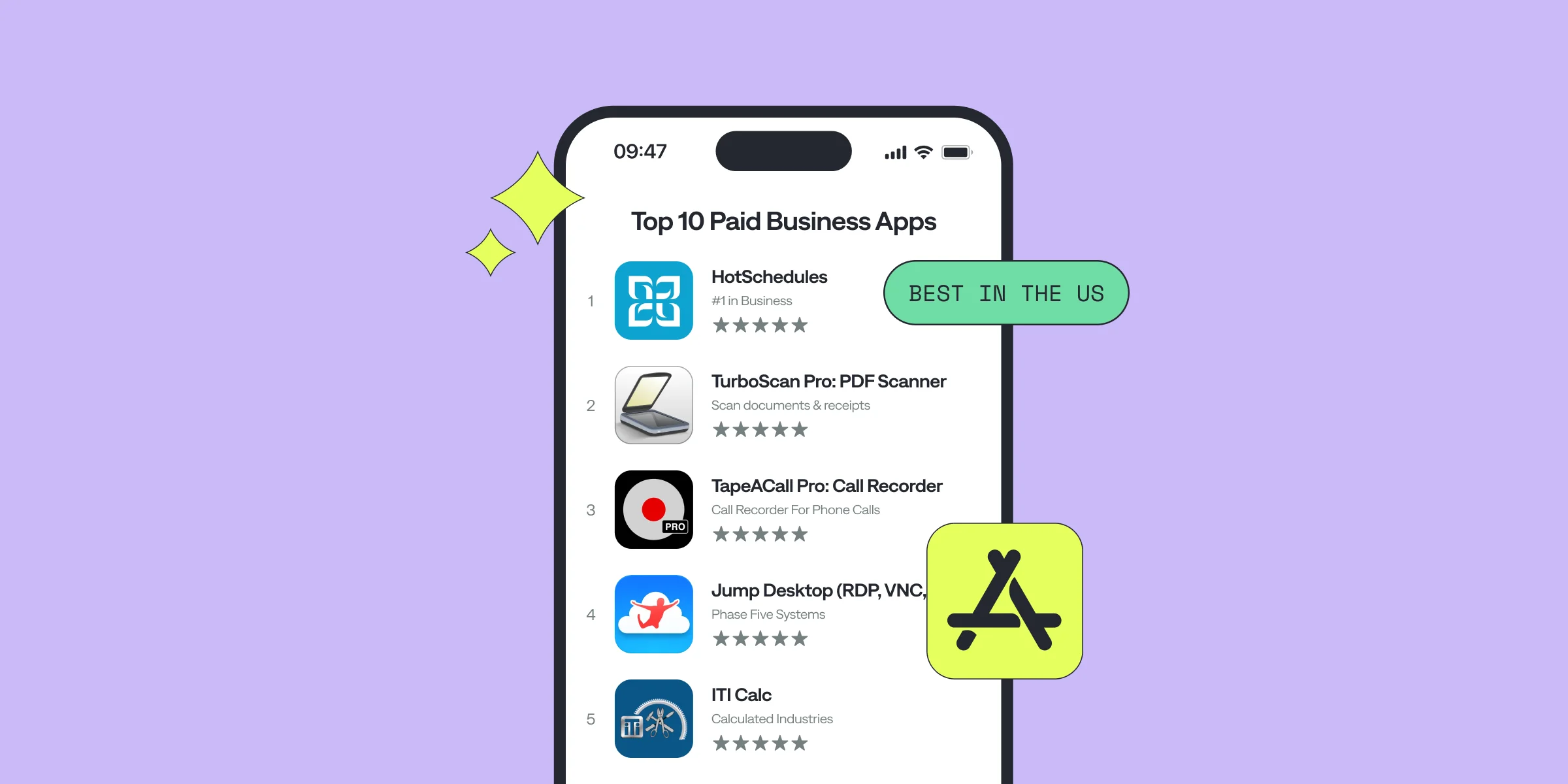

Top 10 Paid and Subscription Apps in Business Category

Oct 9, 2024

Oct 9, 2024

Top 10 Paid Apps in Sports According to the App Store

Sep 27, 2024

Sep 27, 2024

All on Apple Fiscal Calendar: 2025 Payout Dates

Sep 13, 2024

Sep 13, 2024