coming soon

Ready to scale your App's Growth?

Get real-time data on your App's performance and price intelligence rating based on millions of other apps analyzed

Here at Conversion, we focus on returns. We're dedicated to scaling your brand with paid advertising. Break free and take your brand to next level.

Services

All-In-One Solution

Build, track, analyze, and grow in-app subscriptions for mobile apps with our powerful tools

Highlights

All about Subscription Apps

Read our blog posts to learn more about Subscription Apps Growth

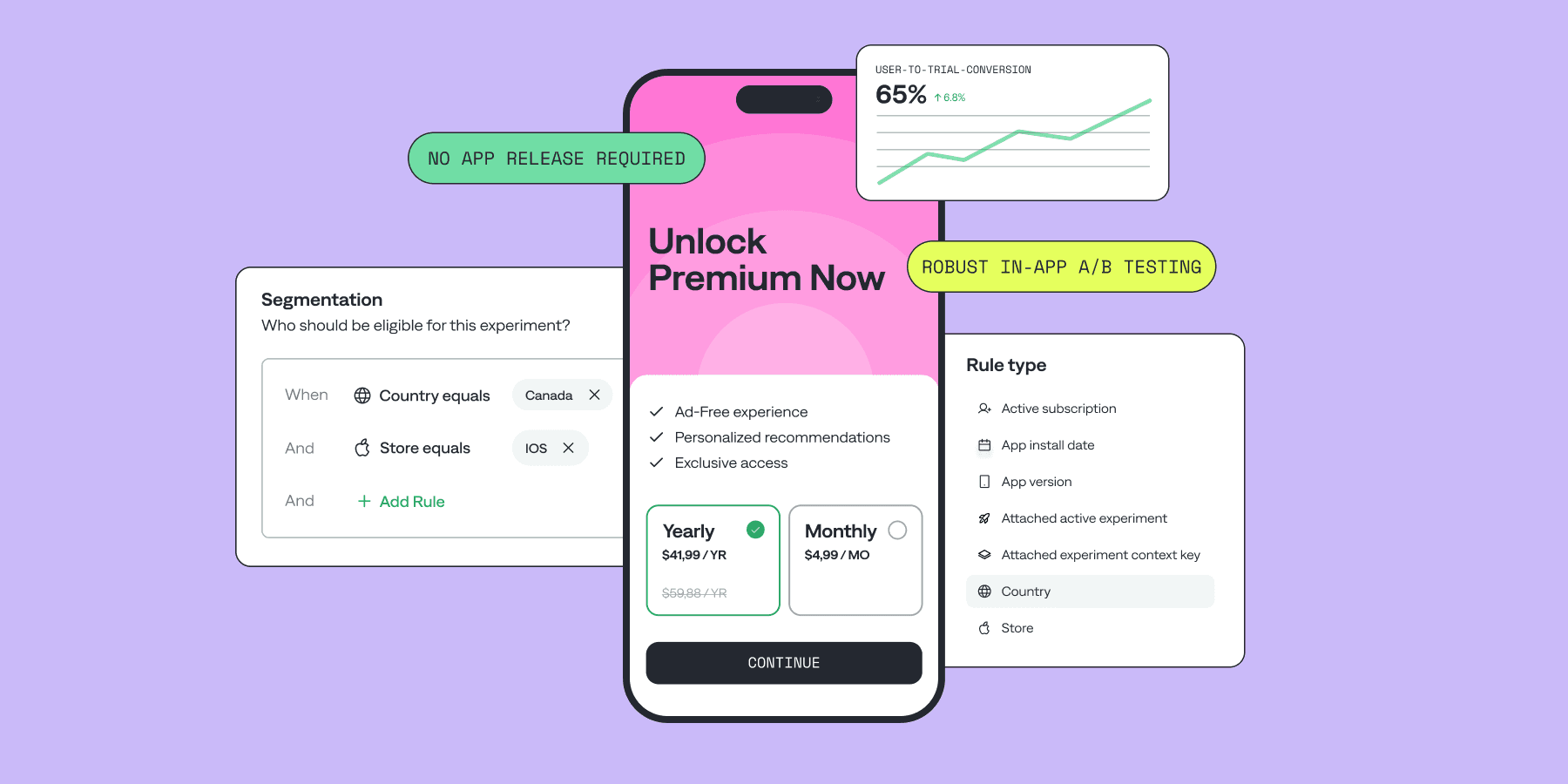

Beginners Guide to Paywall A/B Testing: Examples and Experiment Ideas You Can Try Today

© 2024. Qonversion Inc.